General Partner, Google Ventures at Google

I remember the first time I met Mark Gerson, the

founder of expert network company Gerson Lehrman Group (where I previously worked), as he described how

Gerson Lehrman Group (GLG) first started. Investors (mainly hedge funds at the

time), needed a way to quickly understand an industry they were going to invest

in. One day could be pharma and the next, commercial real estate. Resources

abound online, but the noise-to-signal ratio is high, and the content needs to

be verified and curated. So he teamed up with a few PhDs and set off to write a

book about each major vertical – Healthcare, Technology Media and Telecom,

Energy and Industrials, Retail and Consumer Goods, etc. A few hedge funds

bought the books and Mark went to ask for feedback. The books are great, they

said, but who has time to read them? They wished they could speak with THE

person (or people) that can answer all their questions right now. GLG continued

to build it’s expert consulting network in the years to follow to become one of

the top primary research tools for institutional investors because they have

helped their customers to make things simple quickly.

“Simple can be harder than complex: You have to work

hard to get your thinking clean to make it simple. But it’s worth it in the end

because once you get there, you can move mountains.”

? Steve Jobs

? Steve Jobs

Whether you’re a startup founder, angel investor or

VC, you’ve probably had the need to quickly understand an industry. Dissect the

supply and value chain, understand how money flows and what companies are

playing in each category. Wouldn’t it be great if you could quickly understand

what’s going in mobile gaming, SaaS, marketplaces, etc?

As Steve Jobs said, it’s hard work to make complex

things simple, so I wanted to share a few resources that helped me simplify

industries and verticals. There’s quite a range of information sources from

curated reports to aggregated data.

1) Industry reports

Companies like Gartner, Forrester or eMarketer

regularly produce reports about tech trends and verticals. These tend to be

high quality, but expensive. Tip: many of the top business schools subscribe to

these resources, so MBA students have access to these for free sometimes.

Investment banks and financial services firms like EY, KPMG or Deloitte are

also excellent sources for industry reports. Corporates offer great insights as

well from time to time, but you may have to dig deep in their websites to find

it. Here’s examples from Google Market

insights, Cisco, Microsoft Research, IBM Research or this IHS report on Wearable tech. Usually, the information is high quality.

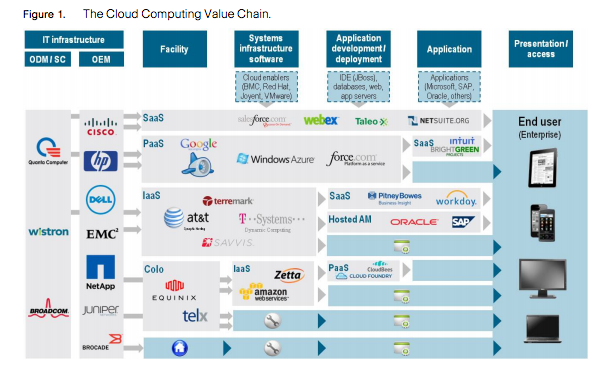

2) Infographics and LumaScapes

“LumaScapes”, the one-pager infographics created

by consulting firm Luma Partners, provide a quick snapshot of the various parts

of an industry and the logos of the companies playing in that space. Check out

the Digital Capital LumaScape below. Other LumaScapes include Content Marketing, Gaming and several more,

which were previously covered here on VC Cafe.

3) OnePagers.io

Yesterday I came across Onepagers, and was instantly intrigued. This new resource by Clement Vouillon aims to crowdsource the most relevant info on a

certain vertical. Pages are already available for Marketplaces, SaaS and Security Software, with several others planned. I’ve asked Clement for

his top sources and in his own words on ProductHunt:

The first stage

is basically “search” only and requires time and effort. The sources are mainly

Google, Twitter, Quora, industry and tech blogs for the resources and for the

startups Angel List, Crunchbase and producthunt.

The second stage requires more “analysis” and the

hardest thing is to get a clear picture based on hundreds of resources you’ve

just read. The more you do it the more you get used to it actually. So for each

trend I need to read a lot, to think about it a lot and then to stop completely

for some time. Then it’s easier to have a clearer picture and to create the

competitive landscape.

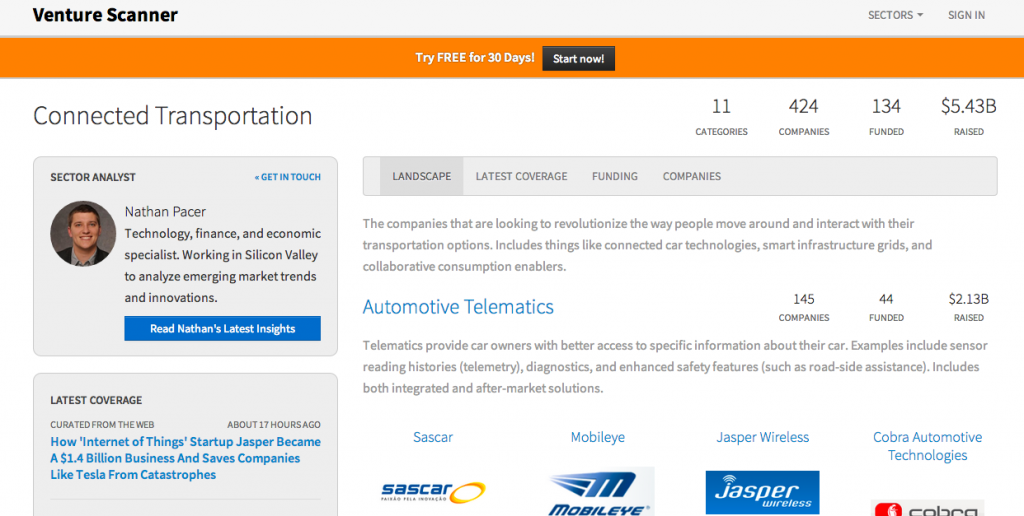

4) VentureScanner

Imagine you could hire a consulting analyst. VentureScanner effectively offers this as they provide sector

focused analyst coverage on a range of sectors (from 3D printing to the future

of TV). 30 days free trial then $99 a month.

“We start with a

real-time market landscape, complete with a comprehensive map of companies

categorized by sector, funding information, and curated articles from around

the web.”

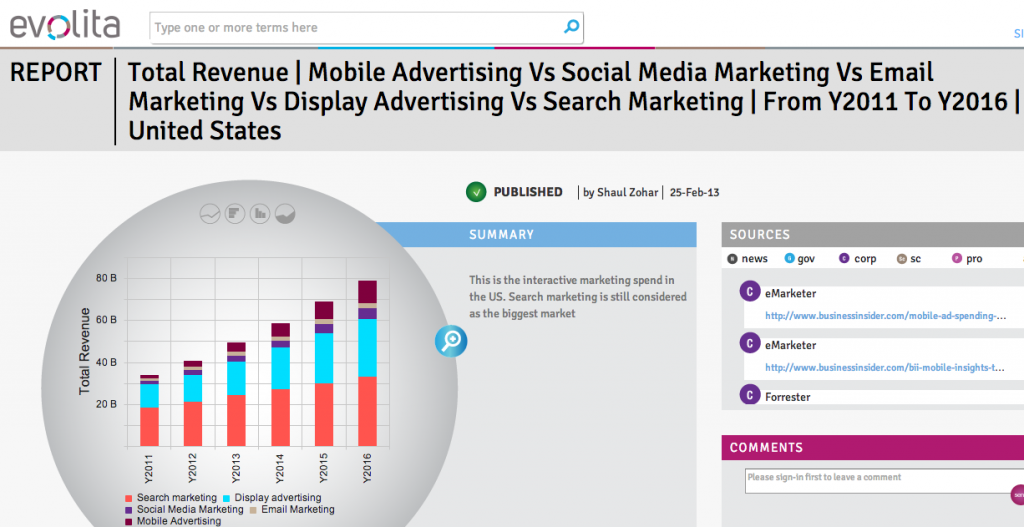

5) Evolita

Visualizing the data is half the battle. Israeli

startup Evolita (still in alpha) takes a variety of

publicly available resources and plots them on pleasantly looking graphs.

6) CB Insights

CB Insights regularly produces data-driven reports and analysis on venture capital, private equity, angel

investment, mergers & acquisitions, IPOs and emerging high-growth

industries. Also recommend checking out the research blog.

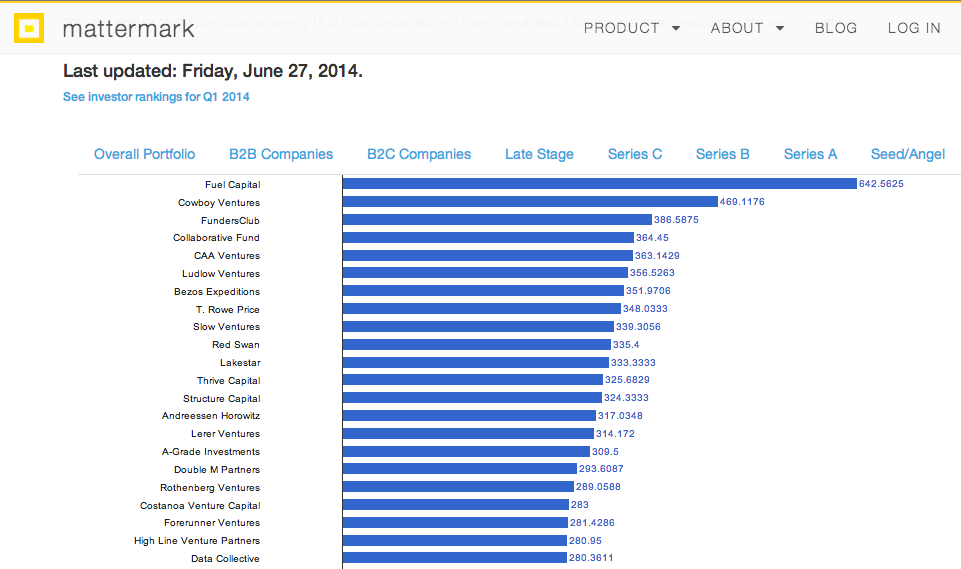

7) Mattermark

Mattermark’s goal is to track growth signals from all

private tech, media and telecom companies. Mattermark assigns a score to private companies, determined

by the growth of 6 signals: web traffic, mobile downloads, inbound links,

Twitter followers, Facebook page likes and Linkedin followers. Mattermark

also ranks investors performance by tracking dozens of growth signals

including web traffic, mobile downloads, inbound links, employees, and social

media for more than 200,000 private companies. Using this service makes it easy

to see where VC money is flowing and what companies are performing.

8) Clarity

Clarity.fm, similar to Google

Helpouts, offers an

on-demand expert network for startups. The San Francisco based startup offers a

marketplace for expertise, where entrepreneurs are able to ‘consult’ with

experts on a pre-determined price per-minute. Want to really

understand an industry? There’s nothing like speaking to the people who are in

it.

9) Quora

Quora offers a wealth of knowledge, where experts take

the time to elaborate on a thoughtful response. The challenge is that quality

varies and many great questions remain unanswered. So, if you want to build

good karma, answer a few questions where you bring expertise and help this

community grow. Here’s a good answer for the purpose of understanding

industries: How does the TV industry work? and here’s a poor one for comparison How does the

Fashion industry work?

10) Google Data Explorer and Google Market

Insights

Originally launched in 2010, the Google Data Explorer makes large, public-interest datasets easy to

explore, visualize and communicate. The tool aggregates various publicly available datasets and

helps you plot them on graphs (see example below). Google Insights shares the studies conducted by Google on

various industries from high-level

visions to deck-ready data points.

Check out the Databoard for Research insights to get the up to date stats for your

research or build your own infographic.

Bonus

11) Whale Path -

Whale Path provides on-demand, fully customized market

research and competitive analysis by letting the user define their research

needs and outsourcing the research bit to a pool of qualified researchers.

Quotes are provided within 48 hours.

Ultimately, you have to curate your resources. My

recommendation is to use these in a mosaic approach, piecing together bits

of information that will eventually create the big picture. It’s not enough to

list the companies in the industry, or know who got funded, but if you’re able

to understand the value and supply chain and add company information on top,

you’re getting close. For that reason, OnePagers.io excites me the most. I look forward to seeing

what will come out of it once it’s open to the crowd for curation.

Thank you for reading another one of my posts done just for you! If you liked what you read please share it by using one of the buttons up top and check out other posts in this blog. I don’t want you to miss out on future posts so please follow me on Twitter @Eurodude23. If you haven’t done it already, please like my fan page by clicking here! See you next time!

Thank you for reading another one of my posts done just for you! If you liked what you read please share it by using one of the buttons up top and check out other posts in this blog. I don’t want you to miss out on future posts so please follow me on Twitter @Eurodude23. If you haven’t done it already, please like my fan page by clicking here! See you next time!

This is a repost of an article that appeared on vccafe.com on August 11, 2014

This comment has been removed by the author.

ReplyDeleteTools and tools everywhere… How to make this decision, which tool is the useful one amongst all? Google

ReplyDelete